Always be skeptical of someone who tells you the market is wrong. I believe the market can be very inefficient, offering attractive opportunities, but you must be careful. I especially turn a skeptical eye when the "crowd" argues the market is wrong.

Take for example the current argument that the price of treasuries is wildly inflated, pushing yields well below their "natural" price. To start, in a period of activist monetary policy this could very well be true and in one-to-two years we could all be paying through the nose to borrow. After all, the central banks can clearly create inflation if they are determined enough. But, let me humbly make the assumption that the yield on treasuries is trying to tell us that we are in a fundamental deflationary environment.

The point of this article is that I believe monetary policies have been the primary driver of higher commodity prices. The rise in commodity prices has been pushing up inflation from the bottom of the supply chain, offsetting deflationary pressures from excessive supply in segments like retail, housing and shipping. Monetary policies have lowered financing costs, allowing demand to remain somewhat healthy, albeit at the expense of rising consumer debt levels. I'll make my point in a series of questions: Since we are in a period of expansionary monetary policies producing modest inflation, what happens to prices when monetary policies move to neutral? Or, monetary policies lose their effectiveness? Is the treasury market simply anticipating a deflationary environment, or even recognizing the fundamental deflationary forces already at work in the economy?

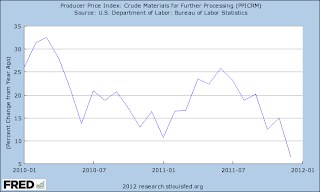

To look at this issue, I have chosen to look at the various inflation measurements. The PPI for crude materials is an inflation measure that includes unprocessed commodities not sold directly to consumers. Examples include crude petroleum, natural gas, coal, raw cotton, construction sand and gravel. The PPI for intermediate goods consists partly of commodities that have been processed that still require further processing, as well as non-durable, physically complete goods purchased by business firms as inputs for their operations. Examples include flour, cotton yarn, lumber, diesel fuel, belts and belting. The PPI for finished goods includes commodities that are ready for sale to the final-demand user, either an individual consumer or a business firm. Finally, I relate the various PPI measures of inflation to both the CPI and Personal Consumption Expenditures Price Index (PCEPI).

The PPI for crude materials increased at an annual rate of almost 20% during 2010 and 2011.

The PPI for intermediate goods increased at an annual rate of of around 8% during 2010 and 2011.

The PPI for finished goods increased an average of 5% during 2010 and 2011.

The CPI increased an average of 2.5% during 2010 and 2011.

The PCEPI, the preferred measure of inflation used by the Federal Reserve, increased an average of about 2% during 2010 through 2011.

A couple points to take away:

(1) The largest price increases occur early in the supply chain, impacted by

commodity prices. As goods move through the supply chain, and a greater

percentage of cost becomes labor and other expenses, the overall price

increases diminish. I believe this highlights an ability to offset higher commodity prices with deflationary forces of labor rationalization and technology investments. I believe it also highlights an inability to pass along higher costs due to excessive supply later in the supply chain.

(2) All five of these indices peak around the middle of 2011. The PPI measuring crude materials peaked in June at 25.8% annual increase, followed by the PPI for both intermediate and finished goods in July at 11.8% and 7.2% respectively, the CPI in September at 3.9%, and the PCEPI at just under 3% in September. I believe these sequential peaks further illustrate the fundamental driver of inflation, which is commodities as they move through the supply chain.

(3) The price increases for PPI crude materials has slowed dramatically in 2012, likely causing the slowing price increases in all the other price indices. The slowing commodity price increases are likely due to multiple factors, such as more supply coming on-line, moderating demand as management teams substitute inputs and change products to offset price increases, and modest economic growth.

My conclusion is that aggressive monetary policy has been driving inflation from the bottom of the supply chain through commodity prices. Companies have been offsetting these cost increases through cost-cutting activities to improve efficiencies. Companies are able to improve efficiencies because there is slack in the labor force, both from a high unemployment rate and access to cheap foreign labor, and due to relatively inexpensive cost of capital, in the form of low interest rates. Additionally, commodity price increases are moderating, which may ultimately help economic growth. If the primary driver of inflation is moderating, and there remains excess supply in the economy, there is increasing potential for deflation unless central banks take expansionary policies up another notch.

No comments:

Post a Comment