Throughout last year my main theme of Sagflation was very macroeconomic and top-down. This theme of fundamental deflationary forces in the economy offset by an aggressive monetary policy led me into my large position in 30-year Treasuries last spring. Last April, when I began buying large positions in longer duration treasuries, I received a few raised eyebrows from friends in the investment world who felt treasuries were over-priced. It is at these times, when I'm taking a contrarion view, that I rely on my analysis and knowledge of the markets to provide the intestinal fortitude. I also make sure I have a defined release point, should the markets move against me, in order to cover some downside risk.

Going

forward, I continue to use my Sagflation theme as a back-drop for 2012.

Fundamental deflationary forces remain in play, in my opinion, due to

(1) multiple decades of over-investment fueled by declining interest rates, and

(2) slowing demand as a result of the consumer and sovereign debt

burden. Examples of over-investment include (1) the Baltic Dry Shipping Index down over 90% from 2008 due partially to over-building in ship yards, (2) the on-going weakness in housing, which may have spread to Canada and China, and (3) a glut of retail space, despite recent strong performance by retail REITs, exasperated by a shift to online shopping

(eg. the Borders and Blockbuster bankruptcies).

Going

forward, I continue to use my Sagflation theme as a back-drop for 2012.

Fundamental deflationary forces remain in play, in my opinion, due to

(1) multiple decades of over-investment fueled by declining interest rates, and

(2) slowing demand as a result of the consumer and sovereign debt

burden. Examples of over-investment include (1) the Baltic Dry Shipping Index down over 90% from 2008 due partially to over-building in ship yards, (2) the on-going weakness in housing, which may have spread to Canada and China, and (3) a glut of retail space, despite recent strong performance by retail REITs, exasperated by a shift to online shopping

(eg. the Borders and Blockbuster bankruptcies).In the following section I review the past thirty years and present my hypothesis that the full deflationary pressure from technology advancements in the 1980's and 1990's went unrecognized by the Federal Reserve. This, in turn, resulted in a targeted inflation rate above what was sustainable, leading to excessive investment and "irrational exuberance." By 2000 there was pent-up deflationary pressure but a combination of extraordinary events and stimulative policy changes have until now offset these deflationary pressures. Indeed, in my view, the deflationary pressure has actually increased over the past decade, resulting in an escalation in the aggressiveness of stimulus measures that increasingly pervert the efficient allocation of capital in the economy.

A Brief Overview of my View on How Deflationary Pressure Built-up

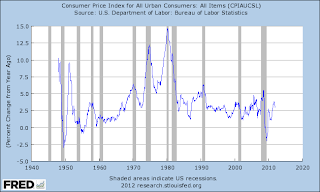

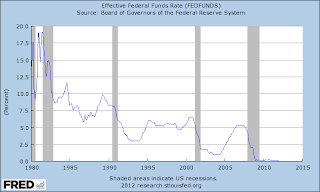

I believe the fundamental deflationary pressure has been building for years, likely beginning in the 1980's with the significant technology advancements during the decade, and continuing through to present day with the business reorganizations that the on-going advancements enabled. Yet the Consumer Price Index averaged around 2.5% for the past 3 decades due largely, in my opinion, to an expansionary bias in the Federal Bank combined with aggressive monetary easing during recessions. On the one side I believe the economy enjoyed falling operating costs within businesses due to improving efficiencies. On the other side the Federal Reserve was targeting an inflation rate around 2-3%, which it expertly maintained by expanding credit in the economy through declining interest rates.

I believe the fundamental deflationary pressure has been building for years, likely beginning in the 1980's with the significant technology advancements during the decade, and continuing through to present day with the business reorganizations that the on-going advancements enabled. Yet the Consumer Price Index averaged around 2.5% for the past 3 decades due largely, in my opinion, to an expansionary bias in the Federal Bank combined with aggressive monetary easing during recessions. On the one side I believe the economy enjoyed falling operating costs within businesses due to improving efficiencies. On the other side the Federal Reserve was targeting an inflation rate around 2-3%, which it expertly maintained by expanding credit in the economy through declining interest rates. From a central bankers view, I believe they view their role as

maximizing real economic growth by spurring on new credit growth. The

problem, in my mind, is defining "real" growth during periods of

extraordinary fundamental change. By the central bankers failing to accurately quantify deflationary pressures produced by improving efficiencies, their targeted inflation rate of 2-3% was above what was sustainable in the economy, in my view. Businesses with significant information processing requirements enjoyed both falling expenses and potentially rising revenue, expanding their economic profit. The increased profit, in conjunction with falling financing costs associated with declining interest rates, led to heightened investment spending as businesses looked to expand and new competitors entered pursuing the attractive profits, in my view. Therefore, I believe that excess capital was building up in the mid-1990's, increasing demand for money and pumping up asset prices as investors competed for scarce resources, leading to Alan Greenspan's "irrational exuberance" comment in December, 1996.

From a central bankers view, I believe they view their role as

maximizing real economic growth by spurring on new credit growth. The

problem, in my mind, is defining "real" growth during periods of

extraordinary fundamental change. By the central bankers failing to accurately quantify deflationary pressures produced by improving efficiencies, their targeted inflation rate of 2-3% was above what was sustainable in the economy, in my view. Businesses with significant information processing requirements enjoyed both falling expenses and potentially rising revenue, expanding their economic profit. The increased profit, in conjunction with falling financing costs associated with declining interest rates, led to heightened investment spending as businesses looked to expand and new competitors entered pursuing the attractive profits, in my view. Therefore, I believe that excess capital was building up in the mid-1990's, increasing demand for money and pumping up asset prices as investors competed for scarce resources, leading to Alan Greenspan's "irrational exuberance" comment in December, 1996. After Greenspan's comments the markets sold off somewhat in the first half of 1997, as they likely started to factor in the Fed allowing for a recession that would work off the excess capital in the economy. Indeed, the Fed did raise the target Fed Funds rate in order to cool the economy. However, a series of events including the Asian financial crisis in 1997, the default by Russia on its bonds in 1998, and the collapse of Long-Term Capital in September 1998 led the Federal Reserve to reverse course and once again aggressively drop the target Fed Funds rate. Once again US businesses enjoyed expanding profits due to operating efficiencies, which drove up demand for further investments in technology and consulting. Once the worst case scenario appeared averted, the Federal Reserve again began increasing the Fed Funds rate in order to address the rising excess capital, but likely not aggressively enough, in my view. Exasperating the issue was the Fed's decision to increase liquidity in the run-up to Y2K.

After Greenspan's comments the markets sold off somewhat in the first half of 1997, as they likely started to factor in the Fed allowing for a recession that would work off the excess capital in the economy. Indeed, the Fed did raise the target Fed Funds rate in order to cool the economy. However, a series of events including the Asian financial crisis in 1997, the default by Russia on its bonds in 1998, and the collapse of Long-Term Capital in September 1998 led the Federal Reserve to reverse course and once again aggressively drop the target Fed Funds rate. Once again US businesses enjoyed expanding profits due to operating efficiencies, which drove up demand for further investments in technology and consulting. Once the worst case scenario appeared averted, the Federal Reserve again began increasing the Fed Funds rate in order to address the rising excess capital, but likely not aggressively enough, in my view. Exasperating the issue was the Fed's decision to increase liquidity in the run-up to Y2K. By 2000 the economy had about two full decades of excessive stimulus, in my opinion. The stock market was on a tear upwards and the dot-com bubble was almost fully inflated. For anyone who lived through the markets in those times, which I did in San Francisco working for an investment bank focused primarily on technology, it was simply crazy. Talk about excessive capital and inefficient allocations, anything with .com in its name could raise millions while companies generating healthy returns with good growth prospects in the "bricks and mortar" world struggled to be heard. The fuel for this exuberance appears to have been the real world cost improvements of technology investments synchronizing with both the required spending to prepare for Y2K and the dream of a new world created by the internet.

By 2000 the economy had about two full decades of excessive stimulus, in my opinion. The stock market was on a tear upwards and the dot-com bubble was almost fully inflated. For anyone who lived through the markets in those times, which I did in San Francisco working for an investment bank focused primarily on technology, it was simply crazy. Talk about excessive capital and inefficient allocations, anything with .com in its name could raise millions while companies generating healthy returns with good growth prospects in the "bricks and mortar" world struggled to be heard. The fuel for this exuberance appears to have been the real world cost improvements of technology investments synchronizing with both the required spending to prepare for Y2K and the dream of a new world created by the internet. The excessive capital can be seen in the general decline in utilization rates, despite industrial production increasing about 5% annually during the 1990's. The Federal Reserve was now aggressively raising rates to deflate the bubble. Well, they succeeded and it popped, resulting in the stock market falling and the economy slowing. The dramatic nature of the slowdown was an indication of the excess in the system that needed to be worked off, in my view. We were in for a painful, but necessary in my opinion, rationalization of poorly allocated capital. Instead, the extraordinary event of the terrorist attacks on September 11, 2001 occurred and the world became a very scary place. President Bush cut taxes and the Federal Reserve cut rates. Working off the economic excesses was put-off as the country focused on healing and responding.

The excessive capital can be seen in the general decline in utilization rates, despite industrial production increasing about 5% annually during the 1990's. The Federal Reserve was now aggressively raising rates to deflate the bubble. Well, they succeeded and it popped, resulting in the stock market falling and the economy slowing. The dramatic nature of the slowdown was an indication of the excess in the system that needed to be worked off, in my view. We were in for a painful, but necessary in my opinion, rationalization of poorly allocated capital. Instead, the extraordinary event of the terrorist attacks on September 11, 2001 occurred and the world became a very scary place. President Bush cut taxes and the Federal Reserve cut rates. Working off the economic excesses was put-off as the country focused on healing and responding. By 2003 the Fed Funds rate was at 1%, the Bush administration had passed significant tax cuts, and the country had declared war on Iraq. Not only had the economy not had time to work off excesses, the economy was dramatically stimulated by the powerful combination of monetary stimulus, tax cuts and fiscal spending increases. In hindsight, it is not surprising that company profits increased, companies expanded, and housing and retail boomed as rising income and low financing rates made a potent combination. The CPI was creeping up closer to 4% but quickly fell below 2% by the end of 2006 after the Fed Funds rate had been increased above 5% near the start of 2006. I believe the fundamental deflationary forces remained in the form of greater efficiency in business with the maturation of the internet, outsourcing of IT and manufacturing overseas, inexpensive communication due to the excessive investments in fiber optics during the dot-com era, and reorganizations of companies and industries to adapt to the new technologies. However, by 2006 the economy now also had excesses in housing and retail, and was on its way to over-building in shipping.

To summarize to this point, the economy has benefited from "good" deflationary pressure associated with technology advancements. However, a Federal Reserve that has under estimated this fundamental deflationary pressure for decades has now encouraged excessive capital to build-up in segments of the economy. This build-up of excessive investment is now providing additional deflationary pressure on the economy. In short, deflationary pressure has built further, driving interest rates lower and neutering the effectiveness of the Federal Funds rate, in my view.

To be clear, central banks do not act in a vacuum. While the headline CPI inflation data maintains a somewhat inflationary level of around 3%, I believe a closer look shows fundamental deflationary pressures that are pushing interest rates lower. Food, energy and medical expenses are the primary drivers behind higher CPI figures. Both food and energy are directly impacted by the higher commodity prices encouraged by monetary stimulus. The growth in medical expenses is somewhat structural, in my view, due to aging baby boomers and the US health care system. The declining GDP deflator, now around 1% annual growth, offers a clearer insight into deflationary pressures over the past few decades and thus a fundamental reason for falling interest rates, in my view.

The Day the World Change

On October 9, 2008 the Federal Reserve made the extraordinary change that it would begin paying interest on both required reserve and excess reserve balances. One of the intended results of paying interest was that the balance of excess reserves held at the Federal Reserve spiked dramatically, making the money multiplier for now irrelevant. Traditionally, interest was not paid on reserves to encourage banks to lend out excess reserves for a profit, creating the money multiplier effect. The Fed increased the monetary base significantly to offset the decline in commercial bank money in the system due to the elimination of the multiplier effect. The change was made in order to enable the Federal Reserve to better control the Federal Funds rate. It also increased the reserves held by the Federal Reserve, providing more firepower to the Fed to use these reserves to purchase securities in the open market, providing liquidity and administering quantitative easing, without materially increasing the amount of credit in the system.

On October 9, 2008 the Federal Reserve made the extraordinary change that it would begin paying interest on both required reserve and excess reserve balances. One of the intended results of paying interest was that the balance of excess reserves held at the Federal Reserve spiked dramatically, making the money multiplier for now irrelevant. Traditionally, interest was not paid on reserves to encourage banks to lend out excess reserves for a profit, creating the money multiplier effect. The Fed increased the monetary base significantly to offset the decline in commercial bank money in the system due to the elimination of the multiplier effect. The change was made in order to enable the Federal Reserve to better control the Federal Funds rate. It also increased the reserves held by the Federal Reserve, providing more firepower to the Fed to use these reserves to purchase securities in the open market, providing liquidity and administering quantitative easing, without materially increasing the amount of credit in the system. This new policy may eventually lead to a "floor system," in which the Federal Reserve raises the target rate for interbank loans, the Federal Funds rate, by several percentage points to prevent an abundance of credit at a lower interest rate. By setting a floor rate, the Fed removes the incentives for banks to lend in the interbank market or issue loans to the public. With enough excess reserves in the system, the floor system enables the Fed to set interest rates independent of the level of reserves in the system. It also enables the Fed to provide liquidity with additional reserves without impacting interest rates, which it has as liquidity provided by commercial banks has pulled back.

A logical question is why have markets become reliant on government-provided liquidity?

A Shortage of Money?

In my opinion, the Federal Reserve's policies over the past 20-30 years have been a form of price control, attempting to maintain "price stability" in a deflationary environment by aggressively lowering the Federal Funds rate and more recently buying longer-term debt instruments. In essence, for the past 30 years the Federal Reserve has maintained a "price floor" by consistently stimulating the economy through new credit growth in order to keep price rises around 2-3%. Economists generally agree that creating a price floor, which prohibits prices below a certain minimum, causes surpluses. I believe the dot-com bubble, housing bubble, and other excesses in the economy are results of these price controls.

The problem, in my view, is that the Federal Reserve has had diminishing success at stimulating new credit growth. From the commercial banks' perspective, I believe that as interest decline there is a diminishing incentive to make new loans, especially as the yield curve flattens and bad credits from the past accumulate. From the perspective of the renters of money, or businesses requiring financing, a build up in excessive capital in the economy results in a diminishing number of project opportunities offering attractive returns. In short, the demand for new money has slackened due to the build-up in excess capital and the central banks effort to stimulate credit creation is increasingly like "pushing on a string."

A side effect of the excess capital, and compression of return on capital as a result, is that liquidity dries up quickly if commercial banks believe other banks may have problem loans. In other words, the money supplied by commercial banks through the multiplier effect has dried up because lenders are less willing, or less able, to make loans. MZM is the broadest measure of money and is defined as money with zero maturity, or put differently, the supply of financial assets redeemable at par on demand. Monetary base measures the supply of notes and coins, as well as Federal Reserve bank credit. At the start of September 2008, just prior to the liquidity crisis amongst banks, there was about $10 of MZM for every $1 in the monetary base. Just three months later there was about $6 of MZM for every $1 in the monetary base. The ratio has continued to compress with now only $4 of MZM for $1 in the monetary base. While this composition shift in the money supply was largely enabled by quantitative easing, it highlights the growing reliance of the economy on central bank money for liquidity. At present I am unclear whether this increased reliance is good (providing more economic stability during a recession) or bad (a sign of weak demand for new credit due to excessive capital). For now, I simply note our greater reliance on the government for liquidity.

A side effect of the excess capital, and compression of return on capital as a result, is that liquidity dries up quickly if commercial banks believe other banks may have problem loans. In other words, the money supplied by commercial banks through the multiplier effect has dried up because lenders are less willing, or less able, to make loans. MZM is the broadest measure of money and is defined as money with zero maturity, or put differently, the supply of financial assets redeemable at par on demand. Monetary base measures the supply of notes and coins, as well as Federal Reserve bank credit. At the start of September 2008, just prior to the liquidity crisis amongst banks, there was about $10 of MZM for every $1 in the monetary base. Just three months later there was about $6 of MZM for every $1 in the monetary base. The ratio has continued to compress with now only $4 of MZM for $1 in the monetary base. While this composition shift in the money supply was largely enabled by quantitative easing, it highlights the growing reliance of the economy on central bank money for liquidity. At present I am unclear whether this increased reliance is good (providing more economic stability during a recession) or bad (a sign of weak demand for new credit due to excessive capital). For now, I simply note our greater reliance on the government for liquidity. There is some concern among leading economists that the large spike in bank reserves may eventually cause inflation to spike should banks move to quickly increase loans issued, thus reducing reserves and increasing the money multiplier. This theory is very much an exogenous theory of money, which may dominate during normal times. I humbly believe the opposite, or a more endogenous theory on money, is now dominant. The spike in bank reserves is like sirens going off that there are fewer attractive investment opportunities in the economy and that poor performance of past capital allocations must be written off before the economy can re-establish itself on a healthy footing. In other words, I believe we must at some point go through a period of defaults and bankruptcies before moving forward. For a similar argument from a different angle, please refer to this article in EliteTrader.

Where to Now?

While our fairy tale may continue for some time, my guess is that it begins to break down at some point this year. There are a number of issues that likely unfold over the next year that could trigger a rationalization of unattractive capital outlays in the economy, in my view. The European debt problems are a high-profile risk that could precipitate capital flows locking up in the US. How well the Federal reserve can offset liquidity issues should be interesting. However, I think we have enough issues closer to home. The Bush-era tax cuts are scheduled to expire at the end of 2012, which sets up another potentially nasty political fight over tax and spend policies leading to a new tax policy and likely a combination of spending cuts and higher taxes. Additionally, the spending cuts agreed upon to raise the debt ceiling begin to take effect in 2013. The Presidential election cycle this year likely magnifies the economic debates, possibly creating expectations of significant tax increases or spending cuts. These are some pretty strong headwinds for an economy living on fiscal stimulation, debt-driven spending, and Federal Reserve liquidity creation, in my view. We can probably "whistle past the graveyard" for part of 2012, but eventually we have to pay the piper.

Let us not forget that the Federal Reserve itself is under increasing political pressure as both parties look for conflicting outcomes of stimulus and reduced intervention. Does the Federal Reserve apply the brakes to the economy by backing off its actions? How could the Fed politically do such a thing when the near future likely holds some combination of growth inhibiting tax increases and spending cuts? The very existence of the Federal Reserve may be at stake should it appear to be slowing economic growth. While I support the existence of the Federal Reserve, I sometimes question how well its leaders understand the longer-term impact of their actions.

So we may continue falling down this rabbit hole to where one day my bank may actually pay me for the privilege of financing the ownership of my house...okay, not likely.

No comments:

Post a Comment